Home Loan Application Delay Real-Time Blackjack Home Financing in UK

Experience Stream State Gaming With Fish Boom Game in UK

January 6, 2026User Satisfaction Peak Reached by Real-Time Roulette in United Kingdom

January 6, 2026

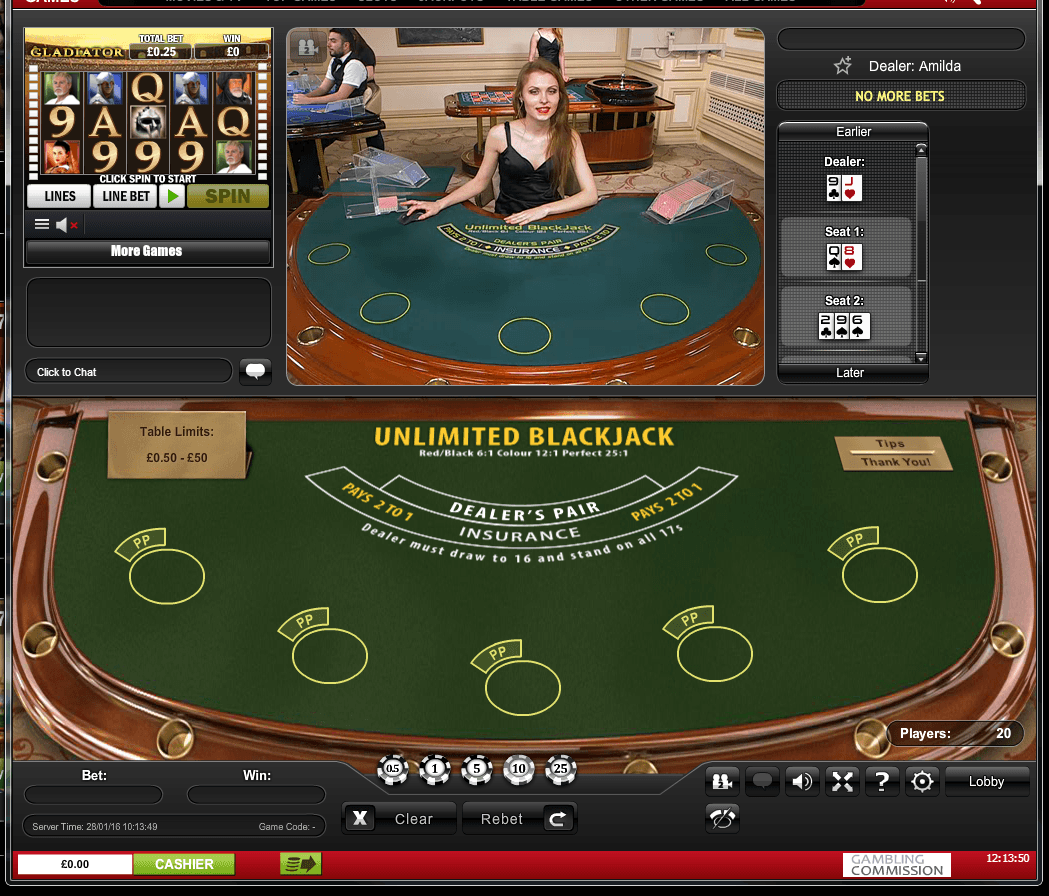

Navigating the mortgage submission process in the UK can be a lengthy process. While you wait for approvals, https://live-blackjack-game.eu/, it might feel overwhelming. However, have you considered how including live blackjack could ease the atmosphere? This unique blend of financial matters and entertainment can change your waiting period into something more pleasant. Let’s explore how this combination not only eases stress but also generates opportunities for meaningful conversations with mortgage consultants.

Key Takeaways

- Engaging in live blackjack can offer a enjoyable diversion while navigating the mortgage submission procedure in the United Kingdom.

- Live blackjack facilitates casual conversations about mortgage options, fostering engagement with financial consultants.

- Utilizing technology for online applications and online evaluations streamlines the property financing process considerably.

- During waiting periods, focus on financial planning and credit rating improvement to boost mortgage qualification and conditions.

- Exploring mortgage options and remaining informed about industry trends can assist you make better financing decisions.

Understanding the Mortgage Application Procedure in the United Kingdom

When you’re ready to buy a home in the UK, understanding the home loan submission process is crucial.

First, evaluate your monetary status; gather your income information, savings, and credit record. Loan providers will consider these factors to determine how much you can loan.

Next, explore for various home loan offers, comparing interest rates and conditions that fit your needs.

Once you’ve selected a lender, you’ll submit an application along with necessary documents, like proof of earnings and identification.

The loan provider will perform a real estate assessment to confirm it’s valued at the sum you want to loan.

Finally, if approved, you’ll receive a mortgage offer detailing the terms, so ensure you read all details carefully before moving forward with the buying process.

The Role of Technology in Modern Home Financing

Completing the mortgage application process opens the door to modern home financing, where technology plays a significant role.

With progress in digital tools, you can en.wikipedia.org expedite your journey to homeownership like never before. Here’s how technology improves financing:

- Online Applications

- Instant Pre-approvals

- Digital Comparisons

- Mobile Apps

- AI Support

How Live Blackjack Enhances the Mortgage Experience

Live blackjack adds an entertaining twist to the mortgage experience, combining entertainment with finance. When you’re dealing with the often-stressful world of mortgage applications, this interactive game can offer a refreshing break.

Imagine sitting at a virtual blackjack table, letting loose while discussing loan options with a mortgage advisor. It keeps the atmosphere easygoing and enjoyable, making it easier to comprehend information.

You’ll find that this environment fosters open conversation, fostering a sense of camaraderie between you and your advisor. Plus, as you play, you can test your decision-making skills in a fun way, which unintentionally boosts your confidence for making financial choices.

Combining fun with serious discussions turns a daunting process into an captivating, memorable experience.

Benefits of Engaging With Mortgage Companies via Entertainment

Engaging with home loan companies through fun activities can transform a typically dull and daunting process into something pleasant and informative.

By incorporating fun into the mortgage journey, you can experience several benefits:

- Enhanced Understanding

- Reduced Stress

- Networking Opportunities

- Increased Engagement

- Better Retention

Ultimately, integrating entertainment with mortgage engagement not only makes it more pleasant, but it also equips you with the knowledge you need for informed decision-making.

Tips for Making Informed Financial Decisions While Waiting

While you’re waiting for your data-api.marketindex.com.au mortgage application to process, what can you do to ensure you make informed financial decisions?

First, review your budget and find any areas where you can reduce unnecessary expenses. This gives you more financial cushion.

Next, explore your credit score and make sure it’s in good shape—if it’s not, consider paying down debts or avoiding new large purchases.

Stay updated on interest rates and market trends, which can influence your final decision.

Additionally, read up on different mortgage options and their terms to comprehend what suits your needs best.

Lastly, stay in contact with your mortgage broker; they can provide useful insights during this waiting period.

Making informed choices now can save you a lot later.

Frequently Asked Questions

What Papers Are Necessary for a UK Mortgage Application?

You’ll need papers like evidence of income, bank statements, ID, and information of your existing financial obligations. Lenders often demand additional paperwork, so it’s wise to check their particular needs before applying.

How Long Does a Mortgage Application Usually Take?

A mortgage request typically takes about four to six weeks to complete. However, it can vary based on factors like lender efficiency, necessary documents, and your financial situation. Staying orderly can help accelerate the process.

Can I Apply for a Mortgage With Poor Credit?

Yes, you can submit an application for a mortgage with poor credit, but your choices might be limited. Lenders may provide higher interest rates or require a bigger deposit, so it’s important to compare offers.

What Is the Smallest Deposit Required for a Mortgage in the UK?

You usually need a minimum deposit of 5% for a mortgage in the UK. However, a larger deposit can enhance your likelihood of acceptance and secure better interest rates, so think about saving more if possible.

Are There Age Limits for Submitting an Application for a Mortgage in the UK?

There aren’t strict age limits for submitting an application for a mortgage in the UK, but most lenders favor applicants to be at least 18. You’ll find it simpler if you’re over 21, with steady income.

Conclusion

Integrating live blackjack into your mortgage request process not only makes the wait more enjoyable, but it also encourages better communication with your mortgage advisor. This light-hearted activity can lessen stress and keep you involved, allowing you to focus on making well-informed decisions. Remember, a little fun can go a long way in navigating the intricacies of home financing. So, relax, play a hand, and stay inspired while you wait for your mortgage approval!