nSIGMA

Provide services like IT, Actuary, Data Analytics and Finance processes.

- Many accountants are embarking on a serious game changer

- The standard explains how an entity should account for insurance contracts and the connected events.

- It comes with the added challenge of implementing new requirements and obtaining sufficient data to comply with the requirements.

- The reporting changes requires companies to transform business process in many areas and systems.

- New components like the unbiased Cash Flows, Risk Adjustment, Discount Rate and CSM are introduced.

- Implementation means making a long-term investment in a system that will be used for the next 10-15 years.

OUR SOLUTION

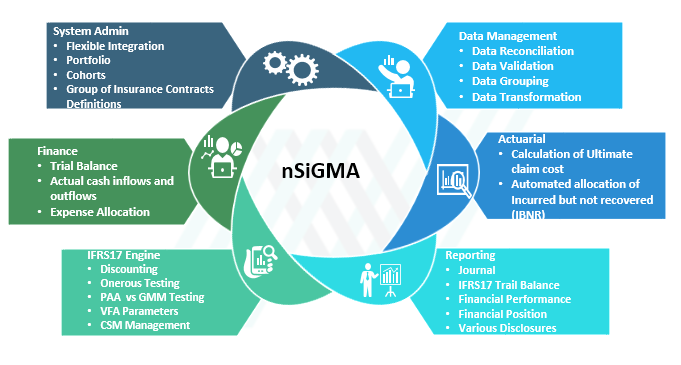

NSiGMA Solution Provides A Comprehensive Solution

- Actuarial

- Finance

- Integrates with policy administration and finance systems

- Automated calculations and journal entries

- Accounting subledger capabilities

- Actuarial estimation, flexible assumptions, review and validate.

- Calculates insurance contract liabilities

- Aggregation and Disaggregation

- General measurement model (GMM)

- Simplified model – PAA

- Variable Fee Approach (VFA)

- Generate built-in financial statements and disclosures in a timely and cost-efficient manner

This will be provide Insurance companies a tool to analyse their business from various angles and also meet the regulatory requirements.

OUR VIEW

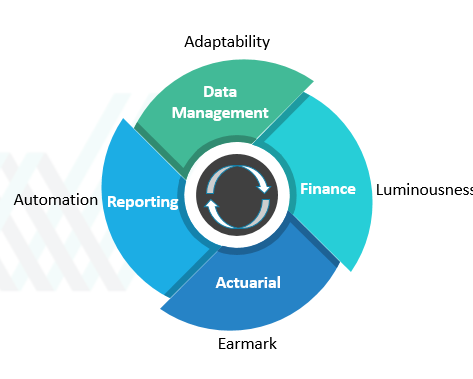

NSiGMA Module Overview

OUR VIEW

NSiGMA Features

PRODUCT HELP

How nSigma Helps You

Dynamic

Adapt to IFRS 17 quickly – improving efficiency and control while reducing risk and cost.

Cloud Native

Access your data on-demand, knowing it’s automatically mapped to IFRS 17 accounting rules

Integrated

Integrates non-invasively with existing systems and report with confidence.

Accuracy

Drill down into the detail with executing calculations with speed and accuracy

Security

Securely managed processes, protected sensitive data.

Collaborative

Brings technology, people and processes together to provide real business value